TSG / ETA Holiday Survey Finds Credit / Debit Cards the Top Payment Choice This Holiday Season

The New Survey Finds Contactless Payments Gaining in Popularity, with 61 Percent of Users Planning to Continue Usage

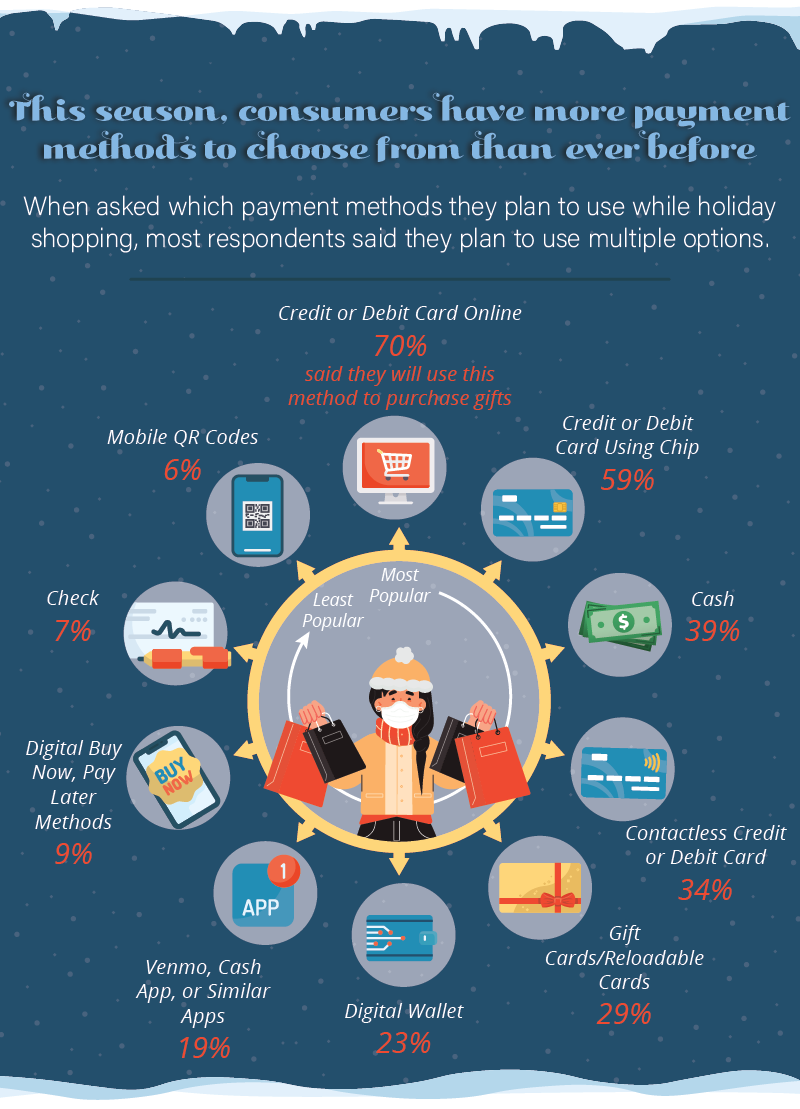

WASHINGTON, D.C. – November 24, 2020 – Today, the Strawhecker Group (TSG) and Electronic Transactions Association (ETA) released a Consumer Holiday Spending Survey report that shows consumers are utilizing different types of payments options as they attempt to shop safely, both in person and online, this holiday season. For in person purchases, over 72 percent of consumers will use electronic payments as their first payment method choice, which includes traditional credit/debit cards, contactless cards, and digital wallets as the top methods. For online purchases, traditional credit/debit cards were cited as consumer’s number one choice, followed by 1-click payment options, and digital wallets.

“As we’re all aware, the COVID-19 pandemic has changed the way most consumers work and live,” stated Jodie Kelley, CEO of ETA. “Fear of exposure to the virus has led businesses to expand their digital offerings and consumers to rely increasingly on digital, mobile, and online channels to securely conduct day-to-day activities.”

Consumers are embracing methods that allow them to pay for purchases online quickly and securely. According to survey results, 81 percent of consumers have used 1-click payment methods, with 37 percent stating they use these services frequently. The service allows consumers to sign-up once to access their saved cards and then pay securely for purchases across retailers with one click.

Sixty-one percent of consumers that have used contactless card payments reported they had a positive impression. Many consumers have also tried emerging payment methods like buy online pick-up in-store and curbside pick-up (27 percent), digital wallets (25 percent), and delivery services for gifts (27 percent).

“The COVID outbreak reinforced the already growing trend of online shopping and the general shift from physical to digital payments,” said Mike Strawhecker, President of TSG. “It has encouraged experimentation, coaxing consumers to explore different ways to access products and services and accelerating certain behaviors.”

These finding are consistent with TSG’s Acquiring Industry Metrics (AIM) platform, which shows a nine percent increase in consumer spending using credit/debit cards from February 1 to November 1, 2020. The COVID-19 crisis is accelerating the shift from cash to card usage and the rise of digital payments. Since the start of the COVID-19 outbreak in the United States, consumer spending on credit/debit cards has increased 32 percent in both the grocery and retail store segments. Certain segments of retail, including sporting goods stores, bicycle shops, sports apparel stores, and home supply stores, have experienced increases in consumer spending on credit/debit cards of over 30% from before COVID-19 to present.

Between November 9 and November 11, 2020, TSG and the ETA surveyed 961 consumers in the U.S., with the goal of understanding payment method preferences and spending trends this holiday season. All results are from the perspective of the consumer. The survey represents consumers across various U.S. regions and industries. The margin of error is +/- 4.2% at a 99% confidence level.

About TSG

The Strawhecker Group (TSG) is the largest analytics and consulting firm focused on the payments acceptance industry. TSG serves the entire payments ecosystem and has experience in working on large-scale projects for the world’s biggest payment players. The firm has worked with all card networks, nine of the top ten merchant acquirers in the U.S., as well as leading private equity firms and investment banks.