Report from ETA Member Paysafe Shows Consumers Uneasy with Security of Biometrics

6-3-2019

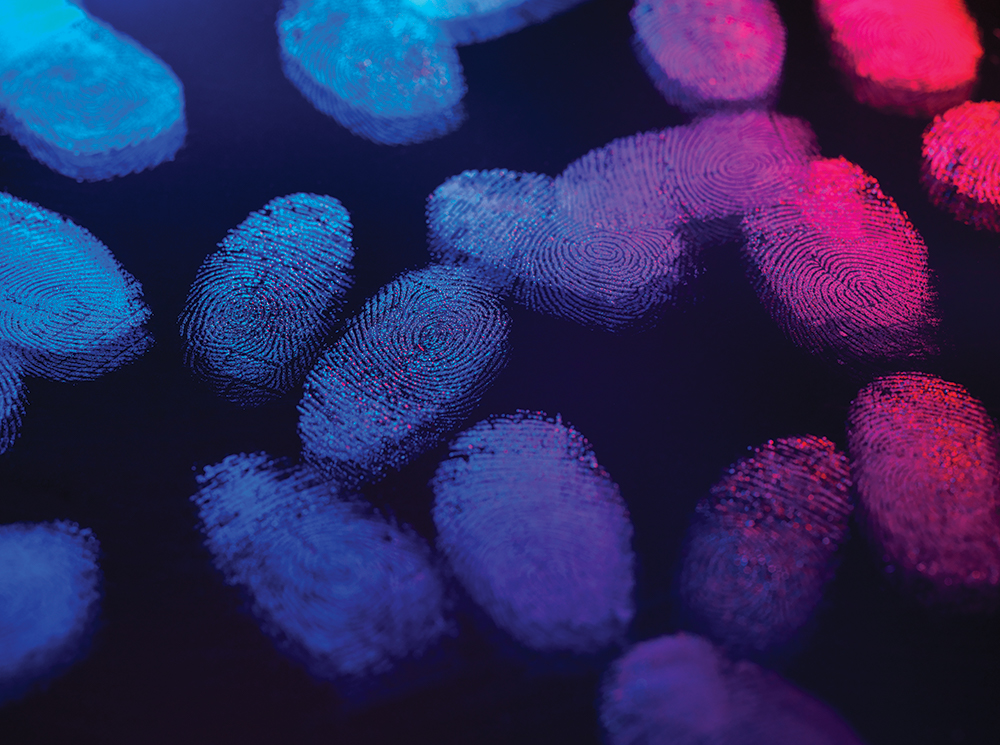

In their latest report released today, titled Lost in Transaction: the end of risk?, ETA member and global payments technology company Paysafe Group says that 52 percent of consumers in the United States are worried that the shift to biometric authentication for online payments will “dramatically increase” identity fraud. Over four fifths – 81 percent – of Americans most favor passwords for authenticating payments online, citing concerns over the security of biometric authentication for making payments.

Only a third of Americans believe that biometrics are more secure than other authentication methods. Similarly, a third of Americans felt they did not know enough about biometrics to trust them. Thirty-nine percent of Americans stated that they did not want companies having access to their personal biometric details. Across North America, 29 percent of consumers were concerned their fingerprint could easily be cloned and used to commit fraud.

“Biometrics are a huge opportunity for the payments industry to combat the increasing risk of card not present fraud. However, it’s not surprising that there is reluctance among consumers to use biometrics as a form of payment authentication when passwords and PINs have been the central pillar of financial data security for at least 20 years,” said Daniel Kornitzer, Chief Business Development Officer of Paysafe Group in a press release. “To overcome this, consumer education is imperative and with SCA coming in September, consumers will need to be aware of the benefits to ensure acceptance and adoption.”

Despite consumer unease, biometric transactions continue to grow. According to the report, 46 percent of North American consumers have used biometrics to make a payment, and 56 percent of US consumers agree that biometrics are a much quicker and efficient way of paying for things.

According to Paysafe, the research was completed among 6,197 consumers from the US, UK, Canada, Germany, Austria and Bulgaria. Respondents came from six different age groups and a variety of different professions. Click here to read more and access the report.

About ETA

The Electronic Transactions Association (ETA) is the world’s leading advocacy and trade association for the payments industry. Our members span the breadth of significant payments and fintech companies, from the largest incumbent players to the emerging disruptors in the U.S. and in more than a dozen countries around the world. ETA members make commerce possible by processing approximately $56.75 trillion annually in purchases and P2P payments worldwide and deploying payments innovation to merchants and consumers.

ETAs membership spans the breadth of the payments industry to include independent sales organizations (ISOs), payments networks, financial institutions, transaction processors, mobile payments products and services, payments technologies, and software providers (ISV) and hardware suppliers. For more information, visit electran.org.

Related Posts

News

Is the Relationship Between Financial Institutions (FIs) And Fintechs Complicated? Not Anymore.

By Sumit Arora, Senior Vice President, Enterprise Payments Strategy, Wells Fargo Building a Balance Between Competition and Collaboration There is a long history between banking and technology, dating back to around 1866 when the telegraph . . .

6-16-2022

learn more

News

INFOGRAPHIC: Tracking the Evolution of Loyalty Solutions

Loyalty programs cultivate lifelong customers. And they’ve come a long way since the days of punch cards. Modern loyalty solutions integrated mobile payments, rewards and ecommerce technology to get customers to keep coming back. For . . .

5-20-2021

learn more