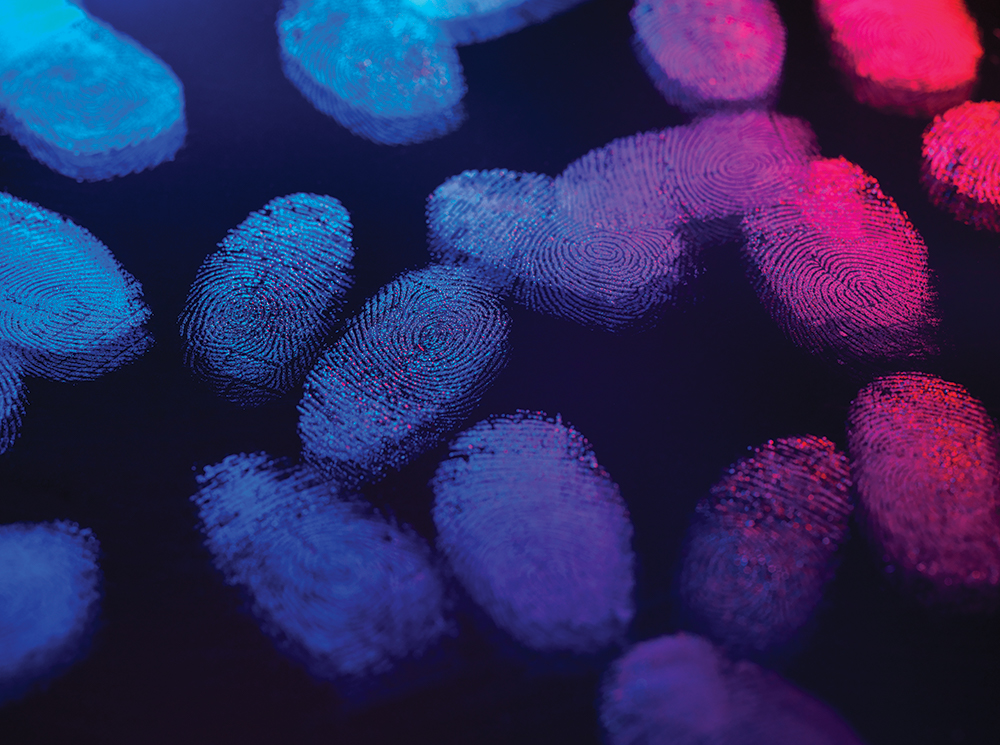

Password Habits Lag for Younger Consumers, but Enthusiasm for Biometrics Pick up Slack

1-30-2018

Making up multiple complex passwords isn’t really in the wheelhouse for young consumers and millennials, a new study from IBM says. But as data security tops the list of concerns for all consumers, younger generations are more likely to use biometrics, multi-factor authentication and password managers, the study found.

Where only 42 percent of millennials are using complex passwords — ones that combine special characters, numbers and letters — 75 percent are comfortable using biometrics to authenticate their identity. For consumers over 55 years old, 49 percent use complex passwords and only 58 percent are comfortable using biometrics today.

Broadly, the survey found, two thirds of consumers globally are comfortable using biometric authentication; 87 percent say they’ll be comfortable in the future.

Younger consumers also have fewer unique passwords – five on average – versus 12 on average for consumers over 55+, making young people more likely to reuse passwords.

Those under 24, at the tail end of the millennials and comprising the fledgling Gen Z cohort, buck the trend on preference as well, the study says. For 47 percent of these young consumers, speed and ease in authentication is preferred over data security. That’s a marked difference from the overall population, where only 14 percent selected convenience over data security for financial applications. But it also might explain why biometrics are popular among younger people, as they often streamline the authentication process when compared to typing in a cumbersome password.

Even still, data security was the top concern for 70 percent of the overall population, calling into question the long-standing mantra that “convenience is king,” the IBM study says. Passwords and PINs are seen as less secure compared to biometrics, the study said, with 44 percent ranking biometrics as the most secure method of authentication, compared to only 27 percent and 12 percent for passwords and PINs respectively. Though biometrics have the capability to maximize data security over traditional passwords, 55 percent of respondents were concerned over the way in which biometric data is collected and half were concerned about others exploiting their biometric data to access their accounts.

Twenty-three percent of Americans indicated they were not interested in biometrics – more than twice the global average.

ETA is partnering with the International Biometrics + Identity Association to produce TRANSACT Tech New York, a one-day event where leading-edge banking, retail and FinTech companies come together with innovative startups and venture capitalists to discuss biometrics, next-generation authentication, and secure and frictionless commerce. The event is on March 13, 2018 at American Express Tower; click here to see the preliminary agenda and register.

According to a release, the survey was conducted between October 21 and November 5, 2017, with a margin of error of +/- 2.0 for the U.S. sample and +/- 3.-7 for the EU and APAC samples at a 95 percent confidence level. The sample size was 3,997 adults across the US, EU and APAC regions.

About ETA

The Electronic Transactions Association (ETA) is the global trade association representing more than 500 payments and technology companies. ETA members make commerce possible by processing more than $6 trillion in purchases in the US and deploying payments innovations to merchants and consumers. Learn more: www.electran.org.

Related Posts

News

Q+A: What You Need to Know About Pre-Authorization Risk Assessment

Card-Not-Present (CNP) authorization rates impact nearly every participant in the payment ecosystem. Legitimate customers suffer and lose trust in the ecosystem when you falsely decline their transactions. Merchants lose the lifetime revenue of customers who . . .

6-10-2020

learn moreno content

News

Report: Voice Payments for Low Value Goods Rise in Popularity

Voice payments are gaining in popularity among consumers despite ongoing concerns about their security, a new report from ETA member Paysafe has found. Over half (57 percent) of surveyed consumers would use voice-activated technology like . . .

7-23-2019

learn more

News

Report from ETA Member Paysafe Shows Consumers Uneasy with Security of Biometrics

In their latest report released today, titled Lost in Transaction: the end of risk?, ETA member and global payments technology company Paysafe Group says that 52 percent of consumers in the United States are worried . . .

6-3-2019

learn more