NEWS

Online Small Business Lending Provides Benefits to Small Business Owners, Finds New Survey

The new study sponsored by a joint trade coalition finds small business owners utilize online business lenders to grow their businesses and to power the American economy. Washington, D.C., October, 23, 2017 – Four leading trade associations – Electronic Transactions Association, Innovative Lending Platform Association, the Marketplace Lending Association, and the Small Business Finance Association…

Read MoreGuest Analysis – Bitcoin Takes Flight: Travel Providers Discover the Currency Invites New Travelers on Board

May 27, 2015 – As bitcoin gains traction in the mainstream, it’s been exciting to follow which merchants and businesses are the latest to add the digital currency as a payment option. Multiple diary-like articles have followed the adventures of journalists trying to live their lives for a time by only spending bitcoin. Of course, news about where bitcoin is accepted has practical interest if you hold the currency and can feel the bitcoins burning a hole in your virtual pocket. What can you buy with them? Where can you go? Can bitcoin pay for your vacation?

Read MoreCAN Capital Releases TRANSACT 15 Payments Survey Results

May 26, 2015 – The payments industry is known for embracing innovation, and 2015 promises massive disruption and technologies that will revolutionize the entire ecosystem. The results of a recent survey conducted by CAN Capital, a provider of alternative lending solutions for small businesses, show that mobile payments are poised to grow exponentially this year. Seasoned payments veterans are competing and collaborating with brand new startups to bring the most cutting-edge mobile offerings to market. In the midst of these new developments, businesses are thinking about how best to adapt to the new reality of EMV cards and NFC-enabled smartphones. When it comes to predicting trends and patterns in the payments industry, it only makes sense to start with the experts. CAN Capital surveyed prominent professionals in the payments and alternative finance ecosystem at ETA’s TRANSACT 15, the premier event for payments education and networking.

Read MoreAnti-Card Fraud Efforts Must Transcend PCI Compliance

Effective anti-payment card fraud efforts must go beyond compliance with PCI standards, according to Visa’s Ellen Richey. She notes best practices already exist that surpass technical PCI requirements, and they include guidelines and recommendations associated with the need for wider adoption of chip cards, tokenization, and point-to-point encryption. Richey also advocates limited storage of card…

Read MoreHackers Increase Attacks on Big E-Commerce and Retail Sites

Cybercriminals are increasingly using phishing attack campaigns to target retailers and banks in countries such as China and India, according to the Anti-Phishing Working Group’s (APWG) latest report covering phishing activity. APWG notes an increasingly large number of retailers who had not been targeted previously became the targets of phishing campaigns during the last half…

Read MoreMobile Payment Groups Aim to Win Over U.K. Consumers

Tech firms, banks, and telecom operators are hoping to attract more U.K. mobile payers and shoppers using a wide variety of mobile payment options. Startup Klarna expects to have its service launched this summer with several British retailers, with the service featuring complex algorithms to check transactions for fraud. Pingit is a standalone app that…

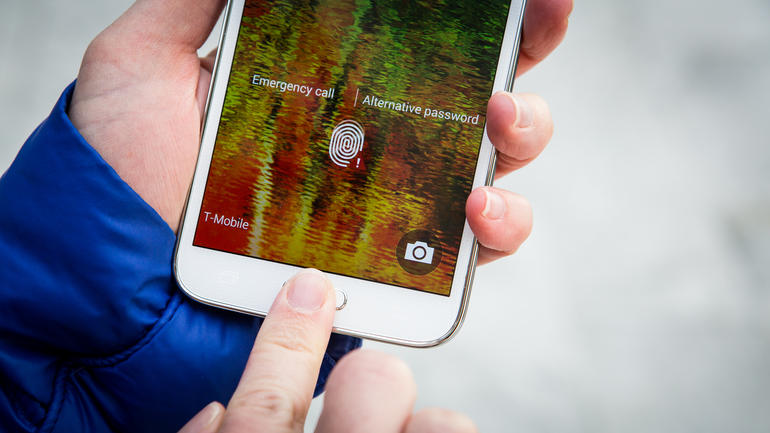

Read MoreBiometrics Eyed for Secure Future Mobile Payments

Payment experts emphasized biometrics as a likely future payment authentication technology at the recent Biometrics Institute Asia Pacific Conference. Kiwibank’s Tony Eyles says biometrics offers a better experience for customers while also bolstering security, while the Australian Payments Clearing Association’s Arun Kendall expects older users to be more resistant to biometric security than others. Panelists…

Read MoreCover App Designed to Ease Restaurant Payments

An new app from the startup Cover aims to ease electronic payments at restaurants through an integrated payment experience, according to Cover founder Andrew Cove. The diner notifies the server that he will be paying with Cover and gives his name, and the Cover app guesses the diner is at the same restaurant, which the…

Read MoreMobile Payments in China Surge 255% in 2014 First Quarter

Mobile payments in China have risen 255 percent year-over-year in the first quarter of 2014 to $623 billion, according to a recent People’s Bank of China (PBOC) report. In addition, mobile payments grew 232 percent year-over-year leading up to the first quarter of 2014. The rising use of mobile payment is boosting the fortunes of…

Read MoreMobile Payment Apps Increasingly Replacing Cash on Campus

Students at Loyola Marymount University (LMU) and many other college campuses are opting to use mobile payment applications rather than cash for all of their purchases. “It’s changed the way we go out,” says LMU student Dillon Siler. “Even interacting with friends. It just makes life a lot easier.” PayPal’s Venmo is one of more…

Read More