ETA Hosts FinTech Policy Forum

9-22-2016

Today, ETA hosted our inaugural FinTech Policy Forum connecting Members of Congress, Hill and regulatory staff, government affairs professionals, industry experts and payments executives to discuss how developing technology and public policy can work together on such topics as privacy, data protection, mobile technology, online small business lending, the convergence of traditional and new players, and helping the underserved.

“The FinTech Policy Forum gave real world examples of how excessive or premature regulation could suppress industry innovation,” said Scott Talbott, Senior Vice President of Government Affairs at ETA. “Alternatively, we heard how policymakers can embrace the transformative potential of FinTech to maximize the benefits to consumers, small businesses and the American economy”

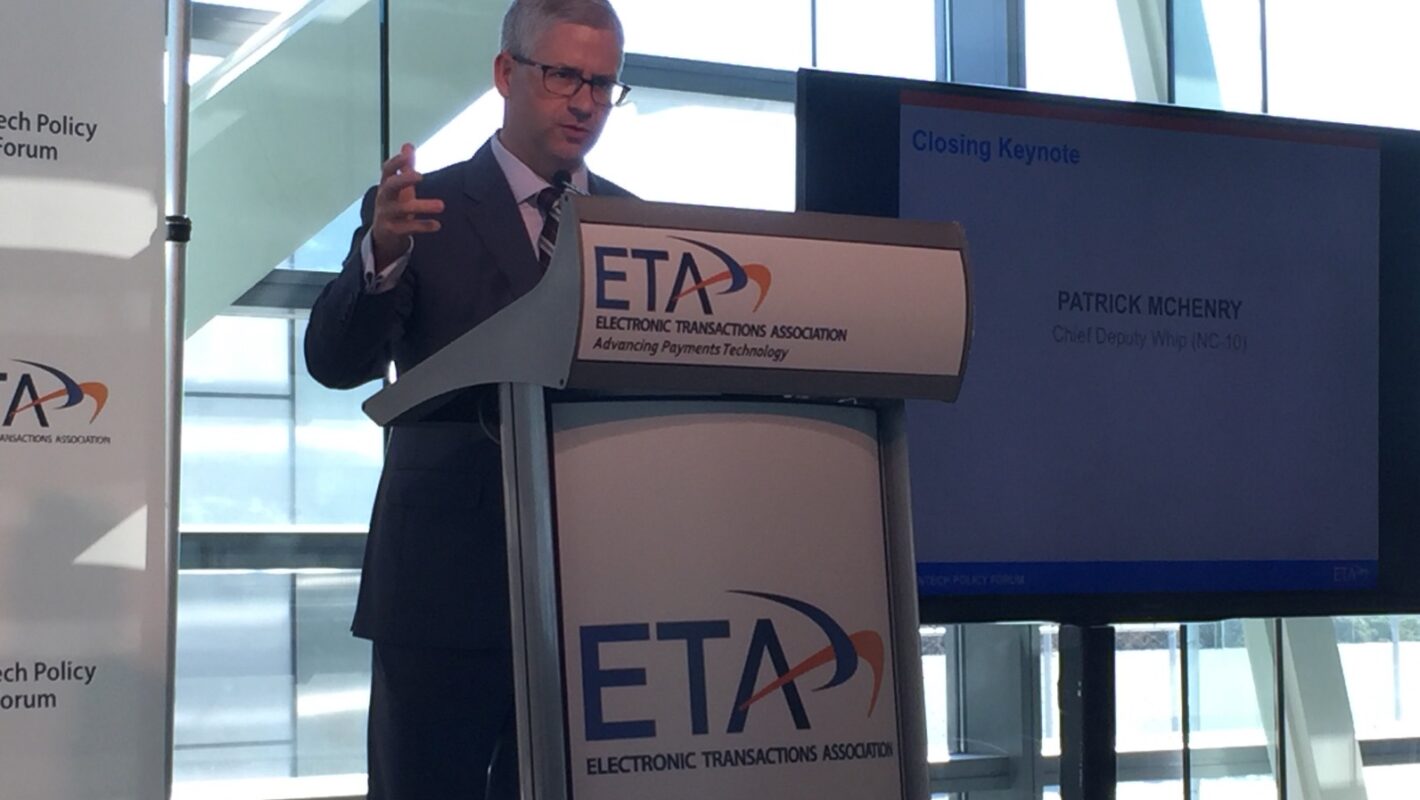

One of the keynote speakers, Congressman Patrick McHenry, the Chief Deputy Whip of the House, announced the introduction of new legislation designed to boost Fintech innovation in the United States. The Financial Services Innovation Act of 2016, is part of the broader Innovation Initiative created by McHenry and House Majority Leader Kevin McCarthy. HR 6188, as it is currently worded, will establish a regulatory framework that helps FinTech firms and startups gain the access and flexibility they need to innovate and experiment. The legislation will mandate that 12 different regulators must establish “Financial Services Innovation Offices” or FSIOs within their agencies. Firms may apply for an “enforceable compliance agreement” with the FSIOs that, if accepted, will allow them to provide an innovative product or service under an alternative compliance plan, which modifies regulation that is antiquated or unduly burdensome.

At the FinTech Policy Forum, attendees were able to engage in frank discussion about opportunities to advance a regulatory environment that supports innovation and sort out any unintended consequences of new regulation or legislation that may stifle innovations fueling economic growth

Hosted at the Newseum in Washington D.C., today’s FinTech Forum featured many notable speakers including Congressman Patrick McHenry (R-NC), Terrell McSweeny, Commissioner, Federal Trade Commission, National Economic Council, and Dan Quan, Senior Advisor to the Director, U.S. Consumer Financial Protection Bureau.

Questions? Contact Scott Talbott, Senior Vice President of Government Affairs, at [email protected].

About ETA

The Electronic Transactions Association (ETA) is the global trade association representing more than 500 payments and technology companies. ETA members make commerce possible by processing more than $6 trillion in purchases in the US and deploying payments innovations to merchants and consumers. Learn more: www.electran.org.

Related Posts

News

Revolv3 Wins the Electronic Transactions Association’s Award for “Best ETA Top 10 Payments ISVs”

2-21-2024

learn more

News

Just the FACs: Scale Your Business with PayFac 2.0

Trends come and go in the payments industry. Payment facilitation followed a predictable trajectory, from the gold rush fever of early implementations to mass disillusionment as major players grabbed market share. In their wake, merchant . . .

3-22-2023

learn more